Friday, July 31, 2009

Wednesday, July 29, 2009

No More Swing Trading until Further Notice

...only day trades from now on!

Not only are shorts being squeezed to death but brokers are charging enormous amount for hard to borrow stocks (TOS charges 17.5% APR to short UA for example - outrageous!) but also there is no more mean reversion for swing trading any positive beta stocks. Every down day looks like a downday untill it gets pumped close to or over the open to close positive. It's disgusting but it's reality.

The only mean reversion left is intraday with 3 minute tick diversions and/or keltner/Boillinger Bands breaches on choppy range days - that it.

Now i'm on a quest after negative beta, high ATR short squeezer stocks like these.

Volatility is plentiful and mean reversion opportunities can be found if one looks hard.

So no more overnight positions, no more disappointments. It basically comes down to looking for weakness in the strongest market leaders: Shanghai, Tech, Emerging Markets.

Granted, Shanghai has shown a great down day today, the real test is throughout the next few days and next week:

Wednesday, July 22, 2009

Tuesday, July 21, 2009

Wednesday, July 15, 2009

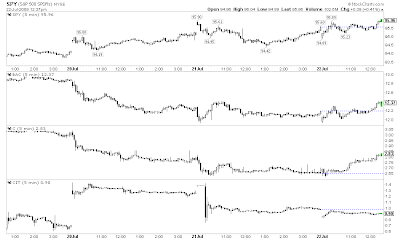

SPX and VIX convergence

Monday, July 13, 2009

RTN rationale

Recently I posted about James Chanos and his bearish sector picks. One of the stocks that he could be shorting that's in the American defense sector is RTN.

RTN is above its key level 43 and will test it this week:

Has already broken 43 support level and now waiting to see if it can hold this key level.

I will add more if I see further attempts to shake out shorts and/or weak volume and lower prices in this range.

Thursday, July 9, 2009

ELX rationale

Sunday, July 5, 2009

Chanos inspired watchlist of long term shorts

Here's the article about James Chanos, the infamously successful short biased hedge fund manager who mentioned he is looking into shorting American healthcare and defense stocks as well as Chinese infastructure stocks.

A quick look at finviz screens revealed therre aren't many of these stocks: no chinese infastructure stocks trade in American stock exchanges, at least as far as I know, but there are a few defense and healthcare stocks available to take a close look at. One of them that sparked my interest from a technical perspective is WLP!:

Fibonnaci confluence on the weekly chart points out 51.50 as a key level which was touched last week as well as 2 weeks ago. Right above this level starts an unfilled gap zone all the way up to

67.That's the bull case.

The bear case, at least from a purely technical perspective as I know nothing about the fundamental case, is if breaks the middle line of the rising channel it started forming since March it would probably be a great swing short trade.

Another bearish scenario is that it starts filling the gap, reaches 53-55 range, breaks both BB and Keltner channels then tanks, leaving the rest of the gap unfilled. This is my favorite scenario because it fits in the repeatitive theme of healthcare stocks being the least bearish in the recent downturn on down days. So while most sectors will continue to tank, WLP will form a higher high but will fail to fill the gap.

As to Chinese infastructure plays, the only stock that's close to that is a coal stock YZC which I'm already short as a technical Head and Shoulders play before bumping into that article.

As for American defense plays, ATK looks like a good short right now:

RTN also looks interesting:

and these are NOT necessarily what Chanos is shorting, just my personal picks from those sectors that look technically bearish in the long term.

Friday, July 3, 2009

SEPR - my best trade ever (to date)

Part luck, part skill (strategy - the Keltner/Boillinger Bands break discretionary strategy that is) that got me this quick +15%

The lucky part - it's a pharmaceutical that had a failed drug

test just after I shorted it

the skill part - it was overbought by my Keltner/BB strategy - I look for a wavy short term chart that retraces at least 38.2fib level of the last short term move that breaks both indicators significantly, meaning: most of the candle has to be outside of the bands'

it also broke out of a multi-month high on pretty pathetic volume:

So it was taken to the woods and got chopped up real good on Friday - happy 4th Sepracor!

_______________________________________________________

Now that i'm feeling sky high it's time to put a cap on my excitement and reduce exposure - that's right, REDUCE, not increase, like the common trading rule is about risk (AKA the better you do the more you can risk on the next trade). Why? because my worst enemy is cockiness. I hate it, it ruined my account too many times so it's time to get more cautious. Not only is my cockiness working against me but there's a whole new intermediate term bearish trend in equities now that is slowly turning into a whole new trading environment. A new trading environment means that much of the structure of the set ups that I've been trading now will change, and untill I know what kind of new environment I'll be swimming in, what kind of new sharks are looming in the deep, there's no reason to keep risking the same amount of capital and look at the charts the same way even though this trend lasted for 4 months now and it seems it won't change that easily. YES IT WILL.

Subscribe to:

Posts (Atom)