I'm starting to get "addicted" to reviewing every second of my recording sessions! lots and lots to learn when environment changes from bearish to bullish:

Thursday, December 24, 2009

Tuesday, December 22, 2009

Euro trade 12-22-09

I've been recording my trading sessions lately, and it's starting to bare fruit pretty quickly, but boy is it exhausting to go over the same 5 hours of trading after trading 6.5 hours. No pain no gain, I guess.

I've been recording my trading sessions lately, and it's starting to bare fruit pretty quickly, but boy is it exhausting to go over the same 5 hours of trading after trading 6.5 hours. No pain no gain, I guess. The benefits so far from recording my own trading are:

- Ability to see mistakes a lot better when not in real time.

- Ability to go over and spot a lot of unnoticed elements such as time and sales patterns, other trend lines/fibs/etc that weren't drawn.

- Ability to pinpoint the right mentality, focus and approach when making successful trades.

Wednesday, December 9, 2009

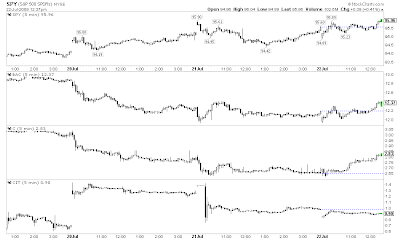

EURO vs SPY long set up 12-9-09

Tuesday, December 8, 2009

Monday, November 16, 2009

Friday, November 13, 2009

Range Day Time and Sales

Market Makers push prices till they see big stop orders, one after the another, then reverse direction. Gotta watch for stops on the bid after a down move and on the ask after an up move that lasts a few minutes.

Wednesday, November 11, 2009

FSLR trade 11-11-09

Tuesday, November 10, 2009

Dollar Long Term Technical Analysis

Monday, November 9, 2009

Tuesday, November 3, 2009

The Goldman-AIG 85$ billion collusion - The Shark Tank Version

I read this very eye opening letter forwarded to Mish by the brilliant Janet Tavakoli of Representative Issa's Letter to William Dudley Requesting AIG Bailout Disclosure. AIG lost billions in CDS'. AIG was the counter party of Goldman Sachs, Merrill Lynch, Société Générale and Deutsche Bank CDS'. Hence, any losses AIG takes Goldman does as well. So instead of going through fair and square free market negotiations over who takes what damage - the federal reserve under Geithner took over their settlement like a bunch of raping pillaging pirates and made AIG take 100% of their CDS losses. The catch? nobody took the losses but the American tax payers since it was all part of the big bad "bail out" plan.

Anybody else speculating on x30 x50 x100 x1000 x10,000 times leverage and losing it all would be considered a criminal and would be sentenced for 150 years of dwelling in a cell with a pedophile with NO BAIL. Wait... that sounds way too familiar.

Then I saw the season finale of Shark Tank, the very interesting venture capital (reality) show.

Besides the amazing last deal, which ended the season with a bang, there was a very micro economic concept that could be applied to the mega deals of the world on the back of the American Taxpayer, or the peasants, as Max Keiser would say:

They started to compete for a great potential start up business, when all of a sudden they realized - why compete with each other while costing themselves more while they can collude together to gain more on the expense of the developers of the start up. This isolated concept applies to Goldman-AIG scandal:

In less than 30 seconds of mega-schmega deal making, Goldman decides that AIG would take 0% losses to its counter party, and the American tax payer will be forced to take 100% of its CDS losses. All 85$ billion.

So Goldman gains 14$ billion, American tax payers lose 85$ billion - "DONE."

Monday, November 2, 2009

Thursday, October 29, 2009

Speculating Fibs

I noticed lately a lot of stocks retrace their fib levels - 23.6, 38.2, 61.8, 78.6 - in ranges that with highs in an uptrend or lows in a downtrend that haven't been reached yet, or don't exist, hence speculative:

Here, for example, the SPY retraced at the 78.6, 38.2 and 23.6 levels without reaching the low of 102.69, so that level would be used as a potential buy/cover level on more downside

Friday, October 16, 2009

Monday, October 12, 2009

Thursday, October 8, 2009

Messing Around with the Max (options) Pain Tool

It'll be VERY interesting following stocks with this interesting simple tool. Gives very defined risks on accurate time frames. Check out their website here.

Thursday, October 1, 2009

Thursday, September 24, 2009

C's HFT machines accelerating the decline 9-24-09

Monday, September 21, 2009

Back to swing trading

but on a very limited exposure using a "new" strategy targeting bullish intermediate term trending stocks that have pretty straight-lined declining highs that break that dip to the upside. It's simple, and all kinds of other filters can be applied like high short interest, shallow pullback angles, etc.

Here's my latest buys as of today:

and another stock that needs to pullback a lil bit more after the recent breakout of its declining diagonal resistance line before I pull the trigger:

All of these picks assume this annoying rally continues till SPX 1100ish

Friday, September 18, 2009

SPY - Falling Wedge 9-18-09

This FALLING WEDGE with a supporting POC makes it seems obvious that there's more upside at least until 109, the top of the gap fill of Oct 16th big gap down.

This FALLING WEDGE with a supporting POC makes it seems obvious that there's more upside at least until 109, the top of the gap fill of Oct 16th big gap down.but of course its easy to forget how overbought we are in the midst of a very sharp exhaustion period in a very stretched bear market rally...

Thursday, September 17, 2009

Monday, September 14, 2009

Saturday, September 12, 2009

A lil weekend financial counter-propaganda

Thursday, August 27, 2009

Tuesday, August 25, 2009

Sunday, August 16, 2009

Selling March 2010 125 GLD Puts

Saturday, August 15, 2009

Wednesday, August 12, 2009

Monday, August 10, 2009

Monday, August 3, 2009

Saturday, August 1, 2009

Friday, July 31, 2009

Wednesday, July 29, 2009

No More Swing Trading until Further Notice

...only day trades from now on!

Not only are shorts being squeezed to death but brokers are charging enormous amount for hard to borrow stocks (TOS charges 17.5% APR to short UA for example - outrageous!) but also there is no more mean reversion for swing trading any positive beta stocks. Every down day looks like a downday untill it gets pumped close to or over the open to close positive. It's disgusting but it's reality.

The only mean reversion left is intraday with 3 minute tick diversions and/or keltner/Boillinger Bands breaches on choppy range days - that it.

Now i'm on a quest after negative beta, high ATR short squeezer stocks like these.

Volatility is plentiful and mean reversion opportunities can be found if one looks hard.

So no more overnight positions, no more disappointments. It basically comes down to looking for weakness in the strongest market leaders: Shanghai, Tech, Emerging Markets.

Granted, Shanghai has shown a great down day today, the real test is throughout the next few days and next week:

Wednesday, July 22, 2009

Tuesday, July 21, 2009

Wednesday, July 15, 2009

SPX and VIX convergence

Subscribe to:

Comments (Atom)